Research & Insight

19 Aug 2024What should investors do when fundamentals and momentum diverge?

As our investors will know, we are solely focused on building concentrated portfolios of companies which enjoy resilient competitive advantages. The sustainable pricing power from these advantages yields durable and predictable cashflow growth with high capital efficiency as expressed in return on investment capital (ROIC). In our experience, there has been a persistent excess return associated with companies which have these sorts of competitive advantages, but these advantages are challenging to identify ex ante and require a large qualitative research effort. We also actively manage valuation and other company-idiosyncratic risks like leverage and cyclicality.

The focus on competitive advantages produces a portfolio which enjoys gross margin, ROIC, leverage, and revenue growth markedly superior to the broader MSCI World index which we use as a comparator benchmark, and also materially ‘out of index’ in its sector composition, with zero weights to materials, real estate, energy, utilities, banks, and insurers.

| Attributes | IFSL Evenlode Global Equity | MSCI World Index |

No. of securities | 33 | 1,429 |

Median market cap (USD bn) | 60.0 | 15.7 |

Return on invested capital (ROIC) (%) | 12.0 | 4.8 |

Revenue growth (5-year CAGR) (%) | 8.2 | 6.3 |

Gross margin (%) | 56.6 | 31.7 |

Net debt/EBITDA (x) | 1.1 | 1.5 |

Carbon Intensity | 0.02 | 0.66 |

Active Share (%) | 86.0 | N/A |

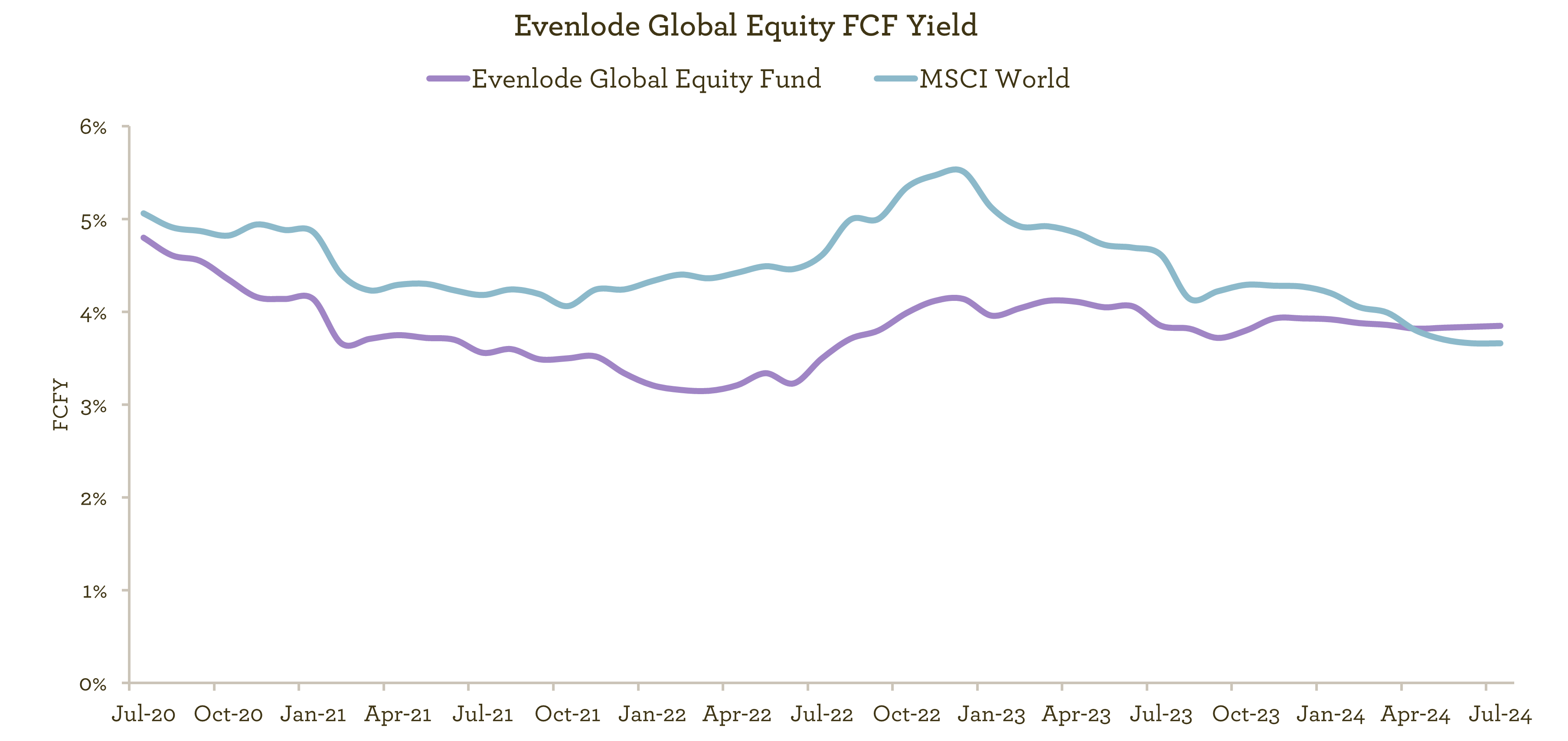

Unsurprisingly, it has historically traded at a premium to the broader index, as shown in this case using free cashflow yield (FCFY) as a valuation tool.

Source: Bloomberg 30 July 2024

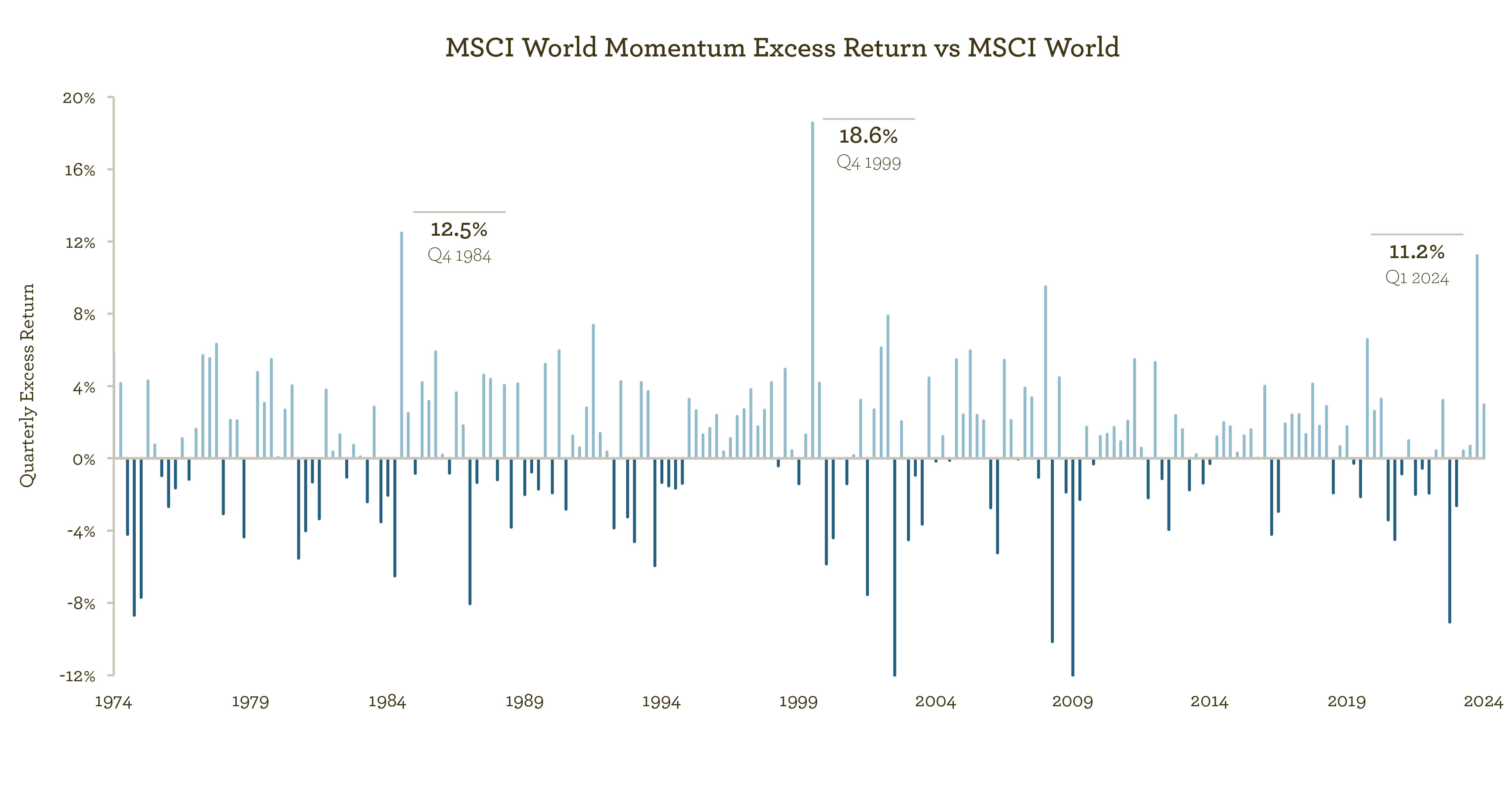

There is a tension between valuation as shown by next-twelve-month FCF and the reinvestment required to sustain a competitive advantage, so we do not use FCFY as a primary valuation tool. Instead, we must quality-adjust a company’s earnings and cashflow to reward companies for proactive reinvestment in line items such as research and development (R&D) and advertising and promotion (A&P). This makes it all the more remarkable to us that the portfolio’s forward FCFY, based on Visible consensus numbers, is now higher (i.e. cheaper) than that of the index, having been consistently lower (i.e. more expensive) since the strategy’s inception in July 2020. This is as a result of the powerful and concentrated rally in a small sub-set of stocks so far this year, concentrated in the semiconductor sector. This rally has driven a historic level of outperformance for the Momentum factor vs. the broader index (as shown in the chart below).

Source: FE Analytics 30 June 2024

The MSCI World index returned 12% in the year to June 30 2024 vs. 3% for the equal-weighted Index, showing the degree of concentration in a handful of winners. Our valuation discipline and our tendency to underweight cyclical sectors meant that the Evenlode Global Equity Strategy has materially lagged the headline index year to date. Reassuringly, this divergence in share prices has not been matched by a divergence in company earnings. Based on our bottom up calculations, portfolio revenue and earnings growth continues to outpace the index through the first and second quarter 2024 reporting seasons.

Our investment philosophy’s focus on persistence of cashflow growth means that we will always follow the signals given by company earnings results rather than share prices. While this can be painful in the short term, the history of stock markets shows the truth of the old adage that in the short term the market is a voting machine, in the long term it is a weighing machine. When the momentum factor becomes unusually detached from sustainable earnings quality, as we believe it has done now, it has a tendency to unwind violently. Evenlode’s focus on managing valuation and other risks such as leverage and cyclicality has historically held its strategies in good stead during times of market disorder. While we cannot predict when the markets will normalise, we think it is inevitable.

Recent market action has demonstrated that risk has indeed accumulated as momentum ran ahead of the broader index. So far Evenlode’s portfolios have proved resilient even despite at times indiscriminate selling probably caused by forced deleveraging of some market participants. In this disordered context, we would like to reassure our investors that our primary focus remains company fundamentals. Based on the first and second quarter reporting seasons, we are confident that our portfolio is on pace to growth both revenue and earnings per share materially ahead of the MSCI World Index as a whole.

Going back to the introductory question, when share prices are telling you one thing, and earnings growth, persistence, and cost (in the sense of valuations) are telling you another, we are always perfectly happy to follow the fundamentals.

Sources: Bloomberg, Evenlode, MSCI, 30 June 2024 Evenlode, CDP 2023 Full GHG Emissions Dataset as at 29 December 2023. IFSL Evenlode, implied holding period based on fund portfolio turnover from 15 July 2020 to 30 June 2024. Past performance is not a guide to future performance. Please see ‘important information’ to the left of this entry.

Research & Insight

30 Jul 2024Reckitt

The recent drop in Reckitt’s share price has been driven by litigation involving Abbott Laboratories, a competitor to Reckitt’s Mead Johnson division. A Missouri jury recently found Abbott negligent for not warning about potential risks associated with its infant formula, a situation reminiscent of Reckitt’s Watson case. The market reaction was exacerbated by the jury’s awarding $495 million in damages, compared to only $60 million in the earlier case.

Though we are factoring in this risk, we would note that the c.£8bn that has been removed from the value of the company since March, compares to a potential liability of up to £2bn if conservative assumptions are made. Reckitt refutes any liability and has received supportive comments from the American Association of Paediatricians. Outside of Mead Johnson, the other 85% of the company is a portfolio of global market-leading health and hygiene brands (Mucinex, Strepsils, Gaviscon, Lysol, Dettol, Finish, Vanish, Durex etc.), which generate attractive 60% gross margins and have good potential to compound free cash flow over the longer-term.

Research & Insight

26 Jul 2024CME Results: What they indicate about the wider market

CME Group is a leading derivatives exchange and recent results were very strong across all asset classes including derivatives on US interest rates, US equity indices, WTI crude oil, metals and agricultural products.

Q2 results were a record for revenue and trading volumes. We think this reflects the ‘risk-on’ nature of markets at the moment, something we have surmised elsewhere, particularly in equity valuations in certain areas. This is despite interest rates staying ‘high’ for longer than expected and inflation still being digested by the economy.

Certain sectors appear to be showing signs of these effects. Luxury goods growth has slowed, with top brands like LV and Hermes holding strong at the expense of brands like Burberry and Gucci (the latter’s profits in the latest period were down roughly -40%). This reflects pressure on the 'aspirational consumer,' or in other words, those whose disposable income is slightly more average than that of the regular Birkin bag customer. Elsewhere, a large supplier of potatoes to the (fried, carb-based) chips industry is feeling the pinch, partly from consumer reactions to prices increases. Recent market jitters suggest some nervousness around the market for the other main type of chips.

CME benefits from volatility in either direction; derivatives are used to managed risk. Their results are an interesting indicator of market sentiment that we will continue to watch closely.

Research & Insight

24 Jul 2024Mark Cavendish

On the 3rd of July, Sir Mark Cavendish won his 35th stage of the Tour de France, the iconic cycling race and one of the biggest sporting events in the world. This makes him the record holder for most stage wins in history. If Cav was a company, he would’ve almost certainly been admitted into the Evenlode investable universe a long time ago.

Cavendish’s durable success and title as the best sprinter of all time comes because he has a durable competitive advantage that cannot be replicated. An important part is his ability to consistently make correct split-second decisions in the chaos of a peloton charging to the finish line. There is something special about his brain that enables him to do this. He is known for having a photographic memory of every detail of every win, down to the lamp post on the left at 175m to go, back in 2008.

None of his competitors can match his experience. Now 39 years old, his first Tour de France stage win came 16 years ago. This year, among many during his career, his chances had generally been written off due to a lack of wins during the season, his age, weaker team and stronger, younger competitors. Yet once again he overcame these short-term challenges to execute where and when it mattered, to the surprise of many, but not all.

We look for companies like a vintage Sir Cav, set up for long-term success, or in other terms, future durable compounders. Companies that have something special, irreplicable, and perhaps are unfairly written off in the short-term. We think there are a few companies that fit the bill. This year’s Tour is meant to be Cavendish’s last, but we wouldn’t bet against him if he decided to turn up next year.

https://www.youtube.com/watch?v=Mt7amdzFVU0

(In the general classification, Cavendish came last at this year’s Tour which was won in dominant fashion by Tadej Pogacar. Much like no analogy being perfect, there is no perfect cyclist; Cavendish is a sprinter whose sole purpose is to win individual flat stages but will inevitably lose time in the mountains, while Pogacar is a climber who seeks to win the Tour overall by gaining time on his rivals when the road turns uphill. Tadej Pogacar would also probably make it into the Evenlode Universe…)

Research & Insight

24 Jul 2024Visit to Informa

We recently travelled to London to meet with Informa CEO, Lord Carter and CFO, Gareth Wright. Our discussions provided a deeper understanding of the company’s current position and strategic outlook. Informa holds around 15% of the live business-to-business market (actually, 30% when excluding single-issue trade association events).

Informa’s half-year results were extremely encouraging, with strong low double-digit underlying revenue growth, with all business segments performing well, and raised guidance for the full year. Informa’s recently announced acquisition of Ascential was also top of mind. Management talked thoughtfully through their decision-making, with Ascential emerging as a compelling opportunity due to its cleaned-up structure and revenue synergies, especially in fintech. We feel that they might even be understating possible cost synergies, as Ascential’s Cannes Lions event seems to be underutilized pricing power, potentially indicating that Ascential’s events margins could surpass.

We continue to see in Informa a very strong UK name, capable of leveraging their market leadings position and excellent economics to compound cash flows for the long term.

Research & Insight

24 Jul 2024Smith & Nephew

Our investment in Smith & Nephew dates back to 2010, during which we've observed a trajectory of strong initial performance, followed by challenges due to Covid disruptions and operational issues. This has resulted in a significant decline in the stock’s total return and a valuation drop from the low-20s to the mid-teens PE multiple. After reducing our position to under 2% by March 2020, we have recently increased it to 3.4%, reflecting renewed confidence in the company’s recovery prospects. The involvement of Swedish activist investor Cevian, which holds a 5% stake, adds an interesting dynamic.

Smith & Nephew has a strong position in each of its three divisions – Sports Medicine, Advanced Wound Care, and Orthopaedics. All are structurally growing markets, driven by aging populations and rising healthcare spending. Smith & Nephew is number one or two globally in most of the categories it operates in within Sports and Advanced Wound Care. These divisions have been growing well and generate approximately 60% of revenue. Its recent issue has been operational challenges in Orthopaedics – the other 40% of the company - where it is number four in a global market dominated by four players. The current management team is focused on improving operational performance, whilst also investing for growth at attractive returns on capital. Investment in research and development has stepped up to 6-7% of sales, relative to c.5% in the pre-Covid era. The company released upbeat results just after the month end, with signs that management’s strategic plan is beginning to bear fruit.

Smith & Nephew’s valuation, at a 17x Price-to-Earnings multiple and a free cash flow yield of 5% looks very attractive.

Portfolio

15 Jul 2024News: Burberry

Trading for Burberry has clearly been very tough since the last quarter of 2023 and fixed costs are – as with all luxury names - relatively high, which results in negative revenue developments dropping through to the bottom line. Whilst disappointing, we do therefore understand the decision that the company has made today, to suspend the FY 2025 dividend. It helps ensure that investments for the future can be maintained through this difficult period. The Burberry position in Evenlode Income is small at 0.85%. This is reflective of a small maximum position size, based on Burberry’s relatively low level of diversification and operational/economic cyclicality. This small position means that the dividend suspension has a relatively limited impact on the fund’s dividend stream, and we continue to expect growth in the fund’s aggregate distribution.

The luxury goods market has weakened significantly, with aspirational consumers tightening their spending habits following post pandemic splurges, and Burberry’s results reflective of this wider industry trend. Our research, including discussions with industry experts, suggests that Burberry’s price increases and brand repositioning in high-end luxury have also negatively impacted volumes. Further work on brand clarity and appropriate pricing are therefore required, and the appointment today of Joshua Schulman looks sensible, given his experience and track record at Jimmy Choo and Coach.

The Burberry brand is strong with more than a century of heritage, particularly in outerwear. Looking ahead, we will continue to consider the balance of quality, risk and valuation appeal for Burberry relative to other opportunities in the Evenlode Income investable universe. With the right strategic adjustments, though, we expect the company to come through this rough patch and benefit from growth in the luxury goods industry over the medium term – with good potential for recovery and growth in free cash flow (and therefore dividends) when they do.

Research & Insight

25 Jun 2024Nike - West Coast Research Trip (part 2)

‘Just do it!’ The infamous ‘Swoosh’. Nike needs little introduction as the global market leader in footwear and one of the most recognisable global brands. We visited their headquarters in leafy Portland, Oregon, with a campus that makes many global universities pale in comparison. This was an amazing opportunity to visit a company that is going through a ‘not so amazing’ time. The company has experienced a notable slowdown in revenue growth after the pandemic, raising questions on its ability to return to high-single-digit revenue growth.

Management were pleasantly candid, acknowledging strategy missteps in recent years: an over emphasis on e-commerce through Nike.com, a reduced presence in wholesale, focus on ‘evergreen’ releases, and a lack of innovation in core performance running. The combination of these errors has opened the door for new competitors, Hoka and On, in the running segment, which is disproportionately important for the brand as a whole. Management admitted that they had underappreciated the importance of physical wholesale for new product launches, as customers have proven less willing to buy new product innovations online than expected. The strategic focus is now on expansion of wholesale doors and increasing research investment behind innovations, such as ‘Air’, alongside heightened marketing, particularly targeting grass roots sports. It is fair to expect that growth could be constrained for a period, though continued performance from ‘evergreen’ releases should offset this to a degree.

Nike remains a behemoth, with brand heritage and scale, supported by athlete sponsorships. Management’s focus is to help the business to return to pre-Covid growth trends noting ‘Sports is the North Star, and not fast fashion’. While this appears a sensible strategy, Nike remains in our investment universe but we are currently awaiting further signs of progress prior to considering an investment in the portfolio.

Research & Insight

24 Jun 2024Airbnb - West Coast Research Trip (part 3)

Airbnb provides an online marketplace for holiday accommodation, with a focus on the vacation rentals market. The company enjoys an advantageous position in travel distribution as a top-of-the-funnel operator. This means that most of its business comes directly to the platform, reducing reliance on search engines or travel aggregators.

Since January 2024, we have held a small position in Airbnb as part of the Evenlode Global Equity portfolio. During our US research trip we visited their San Francisco headquarters and subsequently met with the company again at a New York conference.

Overall, the meetings helped clarify that Airbnb continues to benefit from the network effect generated by connecting its proprietary pool of traveller demand with its fragmented supply of small properties. Listing a property on Airbnb is incredibly simple for hosts who already own the property, creating a highly elastic supply that can quickly expand to meet increasing demand. Even in Paris, the largest Airbnb market, the inventory on the platform has increased c.40% ahead of the Olympics. As a result, Airbnb can capture a growing share of the short-term rental market, which we think is poised to continue growing faster than the broader lodging market, supported by its superior affordability per guest night and the growing proportion of leisure travellers in the overall travel market.

Our visits also confirmed Airbnb's growth opportunities in host services and international markets. Although the company is present in over 200 countries, five core markets still provide the majority of revenues. The company is strategically aiming to boost penetration in non-core markets, tailoring its offering to each market's nuances.For example, in Germany guests want to book early and pay less up front, so a ‘pay less up front’ option has been important for increasing penetration. We will carefully monitor the results, as it will give us important information on the platform’s ability to expand in other underpenetrated markets.

Another avenue for future growth comes from the introduction of dynamic pricing. Hosts generally do not have a good sense of market dynamics to price their property appropriately. Airbnb can do more to help hosts price and account for seasonal fluctuations like school holidays or Taylor Swift concerts. Management concede that this will require further trust building with hosts, who will require faith that the Airbnb pricing will be set with integrity – in other words, not under-pricing in order to build customer faith in the platform at the expense of the individual host, nor gouging which would drive negative guest reviews and damage the host’s brand.

Airbnb’s founder, Brian Chesky, has often stated they are only scratching the surface on what they can sell (flights, car hire, tickets) and has communicated many bold ambitions to the market, which has a degree of cynicism about the elusive dream of cross-sell in the online travel booking experience. During our visits we gained a different perspective than that offered by remote analysis. The CFO, Ellie Mertz, provided a more grounded view, clearly reinforcing the core Airbnb vacation rental strategy and acknowledged that the impetus required to start the flywheel on these newer initiatives will take time. We found this stance reassuring as it demonstrates a more pragmatic approach to growth and a focus on the company's core strengths. However, the disconnect between visionary founder and the day-to-day management of the business is something that we will watch closely.

Given the incrementally positive information about the company, we have modestly increased our position in the company but have not changed our risk scores and our maximum position remains capped at a conservative 3%.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Research & Insight

19 Jun 2024On private label

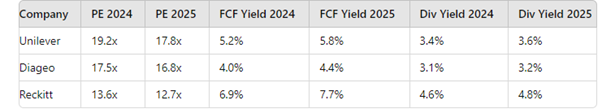

Consumer branded goods companies represent approximately 20% of the Evenlode Income portfolio, with the bulk of this exposure in Unilever, Diageo and Reckitt. Recent reductions in our positions in P&G and Pepsi were made to reallocate funds to more compelling opportunities. For the UK-listed firms, we project mid-to-high single digit per share free cash flow growth driven by volume, pricing, and moderate operating leverage. Their valuations look attractive relative to their growth potential.

Here are some current valuation metrics:

The sector's appeal stems from strong brands and global scale, providing resilience and attractive cash flows. Private label brands are more prevalent in developed markets, especially in grocery categories, but are less competitive in areas like spirits and beauty. Leading businesses like Unilever’s Power Brands and Reckitt’s Health and Hygiene segments benefit from substantially lower private label penetration and higher margins.

Recent trends show that while private label gained share during the covid period, this dynamic is now stabilizing, with leading brands now frequently actually gaining or holding market share. Effective category leadership and strategic investment remain critical to countering private label competition and maintaining market strength.

More generally, the consumer branded goods sector has not been fashionable over the last four years – the market has been more interested in faster growing technology companies on the one hand, and more cyclical business models such as commodity producers and banks on the other. The sector has also produced less predictable results each quarter than investors are used to – due to both Covid-induced demand volatility and an extreme post-Covid input cost spike. Their strong brand portfolios, diversification and repeat-purchase cash flows provide welcome qualities, though, in the context of our through-cycle investment approach.

Market

17 Jun 2024Chinese tariffs

We continue to monitor the rapidly evolving tariff stand-off between China and Europe. This situation has recently escalated, with the EU recently proposing a revised tariff of close to 50% on Chinese electric vehicles. China, meanwhile, some say in retaliation, has launched ominous “investigations” into European luxury goods, agricultural products, food and beverages, as well as vehicles. It seems likely that retaliatory tariffs are on the horizon.

The market is expecting Chinese tariffs to be slapped on cognac by the end of August this year, affecting several companies in the industry, including Pernod Ricard, Remy Cointreau directly. A tariff would certainly have an effect on the price of cognac in China, and thus volumes. The peculiarity of Cognac sold in China is that it is very high-end stuff, priced at over $80 per bottle compared to only $30 elsewhere. Would these tariffs necessitate heavy discounting, and erode margins and brand value? Would this trigger significant inventory write-downs?

Although we don’t hold Remy or Pernod, our investment in Diageo means that we monitor the wider industry dynamics very carefully. We are closely watching these developments, and engaging in ongoing discussions and analysis on how they affect our investment thesis for affected companies.

Research & Insight

14 Jun 2024Paris & Pernod

Last month we ventured to Paris to meet with some French portfolio companies at their respective headquarters. This included a meeting with one of the world's leading spirits companies, Pernod Ricard. Their competitive advantage stems from the strength of their brands. Some include aged products, such as Jameson whiskey, and this delay in production provides high barriers to entry and enforces pricing power through scarcity value.

China is a key geography for Pernod Ricard but has been a headwind which weighed on the company’s performance in recent quarters. The outlook for the country is set to remain weak in the short term. Cognac tariff speculation continues to cause headaches, after the Chinese government launched an anti-dumping probe into EU cognac producers earlier this year. The likely introduction of tariffs will be painful in the short term (putting pressure on volumes) but manageable in the longer term. Despite this, Pernod feel confident that China will continue to be a positive long-term story, with Martell being their flagship cognac product there. Further, the growing middle class will mean more affluent consumers can afford to trade up from local spirits, such as Baiju - a traditional high ABV Chinese liquor. Pernod’s broad premium offering is well placed to benefit from this growth of wealth.

Changing consumer trends have caused some concern around the alcohol industry recently, but at Pernod the mood music is one of confidence. Pernod believe their underexposure to wine and beer mean they’re better placed to withstand any shift in consumption from the global rise in cannabis consumption, which is expected to act as a substitute for alcoholic beverages. Spirits provide greater occasionality – in cocktails, neat, on the rocks – than beer and wine, so give better optionality and therefore should be more resilient to trends. There is also concern that Gen Z are consuming less alcohol. However, this demographic group is still a relatively young cohort for spirits consumption, so it’s difficult to say that there’s a structural decline – spirit consumption tends to be higher amongst older more affluent consumers . A trend more broadly acknowledged has been the consumption of less but higher quality alcohol, which is set to benefit Pernod’s breadth of superior brands.

Overall, we feel confident Pernod Ricard are well placed to continue growing their portfolio of strong global brands in attractive end markets, despite the near-term headwinds which have weighed on recent performance.

Market

25 Apr 2024China's longer-term issues

Recent negative economic and consumer data from China has prompted us to do a deeper dive on some of the trends affecting the Chinese consumer.

Demographic dynamics are particularly concerning: Barclays estimate that the key consumer age-group of 25-45 in China will decline by over 20% in the next decade, naturally triggering a substantial reduction in the workforce. This would eventually reveal itself in lower GDP numbers, and in pinched consumer spending.

The worker-to-retiree ratio in China was about 6:1 in 2000, but has dropped to around 3:1 today, and is forecasted to fall to 2:1 by 2035. This means that a shrinking workforce will have the duty to care for an ever-enlarging retiree population. Filial piety is certainly a great Confucian virtue, but it doesn’t look great in a discretionary spend model. These dynamics combine with growing worries about the levels of indebtedness in China, especially as it relates to real estate, as with property values in some tier-1 cities have recently fallen up to 30%. Worryingly, the sector’s current debt levels are comparable to those in the USA during the 2008 financial crisis.

These dynamics affect a wide range of industries with a heavy contribution from the Chinese consumer, from drinks to luxury goods and beyond, and we keep them in mind when evaluating maximum position sizes and key valuation metrics.

Portfolio Changes

19 Apr 2024New Position: Lindt

We recently initiated a small position in the Swiss premium chocolate maker, Lindt, in the Evenlode Global Equity Fund. Lindt has a 5% share of the global chocolate market, though it operates exclusively in the premium segment, which accounts for 20% of global chocolate sales. As the premium segment expands its share of the overall market, Lindt has also been increasing its own share, by investing in more production and its own retail outlets. This expansion has been most notable in the US, as consumers shift to premium chocolates and chocolate gifting has increased.

Since February, Lindt’s share price has sold off as the price of cocoa futures breached $10,000 for the first time. The price has been pushed to record highs by poor African cocoa harvests, which were affected by increased heat and rainfall from the El Nino effect and outbreaks of a crop disease that reduces harvest yields*. Lindt has already secured its cocoa for 2024, through both physical stores of cocoa and hedging, so will be relatively unaffected in the coming year. While Lindt’s chocolate prices for 2025 will increase to reflect some further cost inflation, the cocoa future contracts for July 2025 are currently 35% lower than the spot price (an effect known as backwardation) and Lindt’s high gross margin allows the input costs to be passed onto the consumer with a relatively small increase in price. Our confidence in Lindt’s pricing power is justified by the Lindt brand and the consumers’ evidenced willingness to pay for a premium product in ‘little luxury moments’. Beyond 2025, we expect supply of cocoa to normalise with improved conditions and increased production from South America – Brazil recently became a net exporter and is ramping production along with other countries. Over time, we expect further growth in the premium chocolate segment and we also expect Lindt to make further share gains in the US. This should allow Lindt to continue to generate high returns on invested capital and to continue to compound cash flows – which in turn drives shareholder returns.

* A special note of thanks should go to our Stewardship team, who produced an invaluable report on the cocoa market, the effects from El Nino, and the potential long-term effects from climate change, before our investment.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Research & Insight

19 Feb 2024Earnings and Magnificence

The fourth quarter earnings reporting cycle is now largely complete for our portfolio companies barring a couple of major exceptions in Europe e.g. Nestlé and Wolters Kluwer. So far our holdings have reported in aggregate organic revenue growth in the high single digits and have continued to expand operating margins. What we have seen so far supports our confidence in the quality of these companies, particularly their ability to redeploy their excess earnings into exciting new areas of innovation.

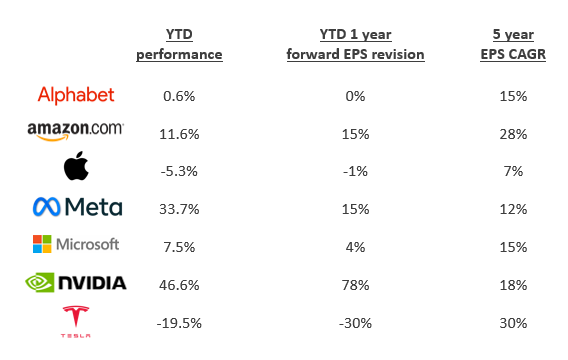

We’ve recently noticed a clear focus in conversations with clients on our views on the ‘Magnificent Seven’ companies. What is most striking to us is the wide gulf between popular perceptions of these companies and how we see them. To us, they are not the uniform club of stock market monsters soaring on tech dreams. They have very varied business models, valuations, and so far this year their share prices exhibit wild disparity in performance, as shown in the table below (accurate as of 19/02/24, USD terms). We do see some common threads in how we’ve selected exposure to this mixed club. The outlying performers on either side of the ledger, Nvidia and Tesla, have earnings which are incredibly hard to predict. While we don’t use year 1 EPS as a valuation marker, the size of the earnings revisions going on is useful market context both for the share price moves and for the underlying businesses. What is most remarkable for both companies is that their extreme 2024 share price performance understates the size of EPS revisions so far this year. Even a high-level analysis of their potential requires challenging analysis into 1) inscrutable adoption cycles for their products (GPUs and electric cars) and 2) the competitive intensity of each category as sky-high stock market valuations lures in new, well-capitalised participants. Furthermore, both work in high capital intensity, high cyclicality industries.

Source: Visible Alpha (earnings estimates), Factset (returns). Data as at 19/02/24. 1 year fwd EPS is basic GAAP EPS estimated for the next financial year. 5 year EPS CAGR is compounding annual growth rate (CAGR) in basic GAAP EPS estimated for the next five years (the first year being the first forecast financial year).

Our preference remains with companies whose earnings are underpinned by clearly demonstrated competitive barriers to entry, stable industry structures, and elongated adoption cycles. These qualities build confidence in the long-term durability of their high returns on invested capital.

The gradual penetration of ecommerce and cloud computing, the two big shared motors for our three holdings in Alphabet, Microsoft, and Amazon, meet these requirements handsomely. All three reported earnings as close to the sedate side as is possible with such closely followed megacaps (fiscal 2023 for Alphabet and Amazon, interim of fiscal 2024 for Microsoft). The core franchises were evidently in good health, demonstrated by growing market shares, increased user adoption and engagement, and meaningful innovations. Amazon and Microsoft shareholders have enjoyed an agreeable start to the year, supported respectively by confidence in improved margins in the e-retail business and by increased adoption of AI productivity tools in Microsoft Office. Alphabet shares have had renewed fears over Search obsolescence hampering them, along with perhaps investor pique that management did not explicitly promise dramatic margin improvements for the year ahead. We think both concerns are overdone. We are now almost one year on from Chat-GPT’s Sputnik moment, and there is no evidence that Google Search is losing share to Bing, which remains a fringe search engine, or Chat-GPT, which has had its greatest success so far as an educational tool. Alphabet continues to enjoy a formidable competitive advantage from its unmatched repository of search user behaviour data. On the earnings front, we like that management have been measured in their promises to the Street and have continued to invest in tomorrow’s growth drivers, particularly in Cloud, Youtube, and wider members of the Google app family.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Market

1 Feb 2024Investec UK Equities Investment Trust Seminar

I recently attended an investment seminar on the topic of the UK investment landscape. Although the UK economy is currently experiencing a "technical recession", influenced by a high cost of living and a troubling global economic backdrop, Investec forecasts a strong recovery in the second half of 2025, bolstered by household income growth, declining inflation, and much anticipated rate cuts.

For me, one of the most significant points discussed was the undervaluation of the UK market. On one estimate, UK valuations are 22% below fair value, contrasting with USA shares’ being an eye-watering 68% above fair value. And this gap affects the attractiveness of the UK as a home of capital: UK pension fund exposure to domestic companies has fallen to a mere 4%. Factors ranging from political changes and shifts in investor focus, towards value rather than away from it, could drive positive valuation adjustments in the UK, offering a strong tailwind to our markets. I left the seminar feeling enthused by the insights shared and extremely optimistic about the manifold opportunities for both value and long-term growth in the UK.

Portfolio Changes

18 Jan 2024New Position: Informa

In January we initiated a position in Informa, a UK-listed events and information services company. Informa manages conferences, exhibitions and trade shows. It is the largest global event organiser in a fragmented market.

The cancellation of live events during the COVID-19 pandemic impacted Informa’s business, forcing it to raise equity and cut its dividend. However, it exited the pandemic with a higher-quality, faster-growing portfolio, as it discontinued a long tail of low profitability events and improved its balance sheet with the timely sale of the Intelligence business, ahead of a higher interest rate environment.

We define Informa’s competitive advantage as the two-sided network effect of the event exhibitors and attendees. The pandemic has alleviated structural concerns about the durability of the business model, as virtual alternatives for events and exhibitions have not worked as well as physical attendance for generating client interest and building order books. This was further demonstrated by Informa’s ability to put through strong price increases as in-person events resumed, underlining the must-have nature of its product and the power of its competitive advantage.

As 2023 events revenue is on track to recover above 2019 levels, our due diligence efforts have been focused on understanding the through-cycle growth rate of the business going forward. Historically, the events business has grown in line with the GDP of its underlying markets. Our discussions with industry experts indicated the group should be able to sustain mid-single digit growth through the cycle. The slight premium to GDP growth comes from our expectations of improved pricing and cross-sell on shows.

Informa also benefits from a steady academic publishing business, which provides a resilient stream of cash flows, and a smaller, early-stage data tech business which monetises the data generated from physical events into marketing insights.

We think Informa can achieve consistent growth through the economic cycle and have accounted for the cyclicality of the core events business with a conservative max position.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Portfolio Changes

17 Jan 2024New Position: Airbnb

We recently initiated a new position in Airbnb within the Evenlode Global Equity portfolio. Airbnb is the global leader in the alternative lodging category and enjoys an attractive market share, brand position, and network effect. Frequent readers will remember our investment process focuses on market growth, competitive advantage, and reinvestment as signs of quality. Airbnb ticks all of these boxes, and it’s worth addressing each of these in turn.

Airbnb operates in the lodging sector (hotels, B&Bs, etc) which tends to grow around 4% nominally per annum. Within that sector, Airbnb has created the ‘vacation rental’ model. Sanford Bernstein estimate that the category, of which Airbnb has about 44% share, has grown to 9% of the total lodging market (by room nights). We expect the vacation rental category to continue to grow materially above the wider lodging market, as lodging demand growth outpaces the supply growth in hotel room volumes, which are constrained by construction and capital requirements. As almost any residential property can be converted into a vacation rental, the category can rapidly flex supply to capture excess demand.

Airbnb's success is underpinned by a robust two-sided network effect between hosts and guests. It has by far the widest selection of vacation rental properties, far more of which are exclusive to its platform. This inventory drives large flows of prospective visitors to its site, making the platform compelling for both sides. As a result, 90% of Airbnb's guests are acquired ‘organically’ through unpaid channels, a unique position in lodging where most competitors, both online travel agencies and hotel chains, are reliant on third party channels such as Google. Despite the organic focus Airbnb remains highly successful in attracting new customers, with about 30% of revenue in any given year coming from guests who are new to the platform. We expect that this will moderate over time, but this is still evidence that Airbnb’s offering remains compelling to new clients. This network effect underpins an attractive take rate of about 13-14% of the total system revenue, which in turn has been reinvested into growing the pool of properties and clients.

We see reinvestment not only in Airbnb’s spending on brand advertisement and its technological platform, but also in its spending on guest experience and its provision of refunds and other remediation payments. In the short term, these are financially painful (5-10% of revenue p.a.), but in the long term, they are an important way to win trust from guests and hosts. Airbnb is a technology-first company which differentiates it from most of the lodging sector, and its management is committed to continual improvement of its online estate, with substantial scope to improve merchandising of rooms and customer journey planning via generative AI.

Airbnb listed in the middle of the Covid crisis. While Covid disproportionately benefited it compared to the rest of the lodging sector, fears of this unwinding, and then latterly fears of an imminent recession, have held its share price down around IPO level for three years. We are mindful of the risks of recession in a cyclical category, although we expect that the secular penetration opportunity will partly offset any declines in a recession. Over the long haul, as travel fully recovers and demand for vacation rentals grows, we envisage Airbnb will continue to compound cash flow at an attractive rate. As such, Airbnb represents a compelling addition to the Evenlode Global Equity portfolio.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Portfolio Changes

16 Jan 2024Exited: Unilever

We sold our stub position in Unilever at the start of the year. On the face of it, this was not a major move, as at the time it represented just 1.2% of the portfolio. However, it remains a large holding in our two sister funds and it’s important that we contextualise the sale, as the decision to exit Unilever is consistent with the different mandates for the three Evenlode strategies.

Unilever remains an attractive consumer staples player which operates in a diversified and resilient range of categories and countries. We respect its stable of brands and its integration with the complex distribution channels in the emerging markets which constitute the bulk of its revenue. In common with almost all companies involved in manufacturing and distributing physical products, the pandemic and the ensuing inflationary pulse have posed their challenges for Unilever, but Evenlode expects the company to compound its attractive economics over time. There is an attractive opportunity to extend its brands, particularly in emerging markets; its portfolio has been increasingly focused on attractive categories like beauty, while de-emphasising commoditising ones like spreads; and Unilever remains a large spender on advertising and research. Finally, the business delivers substantial cashflow every year of which a large percentage heads back to its owners.

With all these strengths being granted, though, the Global Equity strategy has a mandate to deliver total shareholder returns to its investors, rather than the dual focus on capital appreciation and income of our Income and Global Income strategies. This skews its return profile towards capital appreciation, hence it can and should be incrementally more demanding on the key levers of compounding potential – competitive advantage, category compounding, and reinvestment. In the case of Unilever, we see its shareholder return profile having a high tilt to income, in part because of its lower reinvestment in brand promotion and product research relative to other consumer staples companies in our universe and portfolio. This is partly driven by the marginally more mature categories in which it competes, which have lower requirements for incremental innovation and launch spending but also correspondingly more modest growth prospects. Thus while Unilever’s valuation on our proprietary Forward Cash Return measure remains attractive, we have gradually reduced our position since fund launch in favour of other names where we saw more attractive long-term capital appreciation potential. While the fund is now completely out of Unilever, it remains in our investment universe and we will continue to monitor it for opportunities ahead. Following the sale, the Consumer Staples weight in the portfolio at 19.3% is almost precisely in line with the three-year average weight of 19.1%.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Market

27 Dec 2023The 0% alcohol segment – fad or the future?

Recent analysis of the non-alcoholic beverage market has unveiled some interesting trends. In 2022, global sales of 0% alcohol beer and spirits reached almost $18 billion, with beer making up close to 90% of that. The penetration of 0% beer varies significantly by country: from as high as 11% in Germany and Spain, to low-single-digits in the UK and USA. 0% alcohol spirits penetration remains minimal, with the UK at around 1%, for example.

Why would anyone drink a 0% alcohol drink? Well, I have been interested to discover that only 18% of 0% alcohol consumers are actually teetotallers: according to the data, their motivations range from a desire to avoid acting up in a social setting, to health concerns.

Alcohol consumption patterns over the past decade have shown varied trends. While we have seen a 4% drinking decline in the UK (admittedly from a high base, if we’re honest), the USA has seen only a slight decrease; but Brazil is up 7%. And when you dig a bit deeper, the direction of travel isn’t so clear cut: the USA has seen a rise in alcohol consumption among people aged 55+ over the last decade. As ever, trends look very different depending on how wide your lens is.

Portfolio Changes

15 Nov 2023Exited: CH Robinson

We recently exited our position in CH Robinson, the American transportation third party logistics and brokerage company. The company is the leading provider of these services in the US trucking market and has built a competitive advantage based on a two-sided network between small carriers, which frequently own only a single truck, and clients that require goods shipped across the continental United States. CH Robinson benefitted substantially from increasing logistical complexity as we exited the pandemic but experienced a normalisation in transportation pricing over the past twelve months. Such cyclical volatility is usual and did not motivate our decision.

The company had been in a state of flux since the sudden departure of the prior CEO, Bob Biesterfeld in January. CH Robinson gave little explanation of his exit, which directly led us to undertake further research. We held a series of calls with industry experts, former CH Robinson employees, and sell side analysts focused on the sector. These conversations highlighted the difficulties that the prior management team experienced in implementing a new technology platform in US truck brokerage, particularly in convincing “old-school” brokers to adopt a technology that replaces face-to-face client interactions. Our research also identified a probable industry transition, from an asset-light brokerage/technology model to a “drop trailer” model, where the logistics broker also provides the trailer for transportation (rather than the trucker). This both reduces the start-up costs for truckers and allows them to spend more hours on the road, rather than waiting (unpaid) for their trailer to be unloaded. This nascent transition could significantly increase the capital intensity, requiring material investment from brokers like CH Robinson. We spoke with the new CEO, Dave Boseman, who has prior logistics experience from working at Amazon. While we have confidence in his ability to navigate the change in business model and to further implement the technology platform with brokers, the medium-term risks and cash flow requirements are significant. Given the alternative opportunities available, we have chosen to reinvest the capital elsewhere. We will continue following the company and may reconsider it for reinvestment once we have better visibility on the transition.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Webinar

6 Nov 2023Webinar Replay

Chris Elliott and James Knoedler, fund managers, hosted a webinar update on the strategy on the 6th of November.

To watch the full replay please click below:

If you'd like to read the transcript please click here.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of publishing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Portfolio Changes

13 Sep 2023Exited: Estée Lauder

We sold our toehold position in Estée Lauder in August following their much anticipated Q4 2023 results. This was a difficult decision, because Estée has a wonderful portfolio of prestige skincare, cosmetic, and fragrance brands with commanding market positions worldwide. It was also behaviourally difficult, as the share price had declined -38% since we initiated a position last summer. We bought as it had weakened on the impact of China’s sweeping lockdowns. In the spirit of Warren Buffett’s adage about discovering who’s been swimming naked when the tide goes out, we found over the next year that this exogenous shock was unsparing in revealing who had been underinvesting in their franchises. At Estée Lauder, the impact was extreme: a -10% decline in net sales in FY23 with a -52% decline in operating profit, implying a >90% incremental margin on the lost sales.

All experience can and should be turned to profit by fund managers. There are always two important questions: one, what did we get wrong, so we don’t do it again; two, what should we do now with the stock? In the first case, while we were well aware that Estée Lauder appeared to be investing less than its closest peers in advertising and in research and development (R&D), two fundamental yardsticks of corporate health in its industry, we were overly willing to believe that differences in business perimeter (category, channel, price level) and in accounting standards explained away these gaps. The fact that management have now admitted that they need a reinvestment cycle confirms that our initial concerns were valid. Sometimes analysis risks being too granular, as very fine detail is company-idiosyncratic by its nature: it is important that we can compare companies even if at a high level.

This brings us to the second point. What next? Estée Lauder’s brands have a golden heritage evident in their exceptional gross margins; and the global beauty market offers robust growth. But we worry about the brands’ direction. They’ve lost material share in the US, Estée’s most mature market, we think because too many gross margin dollars went to EBIT and capital returns to shareholders rather than advertising and R&D spending. We were troubled by the presentation of Q4 2023 results, in which the hairshirt reinvestment message was undercut by rosy talk of reaching 20% EBIT margins and a rapid comeback in Chinese travel retail. Broker calculations suggested that the FY 2024 guidance implied an exceptionally rapid return to hefty margins and above-market growth in the back quarters of the year.

Our view is that given the investment deficit, getting both margin growth and market share gains sustainably for a long time is unlikely. We had previously capitalised an above-market growth rate in our valuation model, which we have changed to growth at the same rate of the market. We think it will be hard to outgrow the wider market over the long term without more funding for advertising presence and innovation pipeline. We also cut our risk scores related to diversification and management quality. The resulting valuation and risk profile meant that the company wasn’t fair value for the portfolio and consequently we sold. While this was behaviourally painful given the share price decline we’d experienced, it was very much dictated by our process. We retain Estée Lauder in our investment universe, given its brand portfolio’s enviable history, and we will watch it closely over the coming years.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Portfolio Changes

1 Feb 2023For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

New Position: Jack Henry

We recently purchased a position in Jack Henry, a leading provider of banking software to small/medium banks in the US. Its ‘core banking’ software is the basic operating system for banks to update their deposit and loan balances and record transactions. The market has high barriers to entry as switching providers is costly for the customer base and creating a competitor product requires compliance with complex and complicated regulations. Jack Henry’s main competitors are FIS and Fiserv, both of which have been distracted by buying large merchant acquisition businesses. Jack Henry has stayed in its home market, focusing on cloud core banking, mobile banking, and banking payments solutions. We expect high single digit growth for Jack Henry, coming from three main areas: 1) by cross-sell of ancillary services, 2) continued growth in core banking, and 3) cloud migration of banking software.

Portfolio Changes

25 Jan 2023For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

New Position: Synopsys

Last month we initiated a new position in Synopsys, a provider of Electronic Design Automation (EDA) software to semiconductor designers and manufacturers. The EDA market is an oligopoly, shared primarily between Synopsys and Cadence. The client chooses an EDA supplier whilst in early development, based on the available libraries of intellectual property and compatibility with expected circuit components. Synopsys has traditionally led in digital semiconductor designs, while Cadence has a greater library of analogue interconnectors. Once the EDA selection is made, the costs of switching suppliers includes both known outlays (system fees and employee resources) and the unknown significant risk of damaging the design integrity of the circuit, which to fix could run into the millions of dollars. This results in stable and predictable revenue streams for both companies.

Despite short-term cyclical volatility in semiconductor demand and negative wider economic indicators, we believe that demand for Synopsys’ services will continue to grow at high-single to low double-digits over the medium term for two main reasons. First, EDA demand is tied primarily to semiconductor R&D budgets, rather than production volumes, so is relatively resilient. Second, the EDA client-base is also fragmenting, as more companies (from hyperscalers to automotive producers) choose to design their own specialist silicon. This boosts the pricing power of the EDA incumbents and provides a long runway for both growth and shareholder returns.

Valuation

Valuation Discipline; Forward Enterprise Return

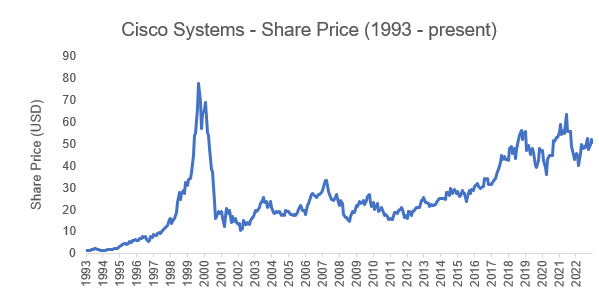

Even great companies can be poor investments when purchased at the wrong price. To illustrate this, consider Cisco’s share price (shown below). In the dot-com bubble of the late nineties and early-noughties, Cisco was seen as the enabler of the upcoming internet revolution, providing the hardware that would allow us all to get online. In a broad sense, this thesis was accurate. Cisco has been a major contributor to the modern world and, between 2000 and 2022, the company grew net income 5.5x – however, the share price has never recovered to its peak of March 2000. Those that invested at the March 2000 peak will have seen little return.

Source: Factset, Cisco share price data from 1993 - 2023

At Evenlode, we use a proprietary, reverse discounted cash flow model (DCF) to value all companies within our investable universes. This model has a long-term horizon (aligned with our investment philosophy) and is informed by the qualitative and quantitative research undertaken by the investment team. The same model is used to value companies across all Evenlode funds.

The key parameters of the model are the delay and the asset growth rate. The delay is a representation of the length of time that a company can maintain its current return on investments before returns decay to the long-term market average. A higher quality company, with a durable competitive advantage and high barriers to entry, can be expected to maintain its return on investment for longer than a lower quality company. However, no advantage is insurmountable, so we cap this delay at 20 years. The asset growth rate is based on the level of investment undertaken by a company, and the ability to generate the cashflow to self-fund investment. All proposed parameter changes are carefully discussed by the entire investment team in our weekly meetings.

The primary output of the valuation model is the ‘forward enterprise return’ (FER). This measure is the discount rate that equates the value of a company’s future cash flows to the current enterprise value (the market value of company debt and equity). This FER measure is analogous to a bond’s redemption yield and gives a market implied rate of return on investment for the company. So instead of making assumptions about what discount rate to use, our valuation measure is the implied discount rate from the current share price.

We typically enter and exit investments based on the FER, as this measure is not influenced by a company’s leverage ratio. However, we expect returns to equity holders to be along the lines of the ‘Forward Cash Return’ (FCR), which performs the same calculation as the FER but only for a company’s future cash flows to equity holders, and its current equity market value.

We do not see the FER as a silver bullet. All valuations are based on a series of predictions about the future state of the world, and these will always be subject to a degree of error (including ours!). However, it is a valuable tool in helping us bias the portfolios towards companies with a better implied return for investors and for avoiding the type of error shown in the Cisco example above. We believe that the combination of careful valuation risk management, together with consideration of fundamental business risks, enhances our ability to provide attractive long-term returns for our investors.

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice. Please also see ‘Important Information’ to the right of this entry.

Manager Diary

This diary records some of our portfolio decisions as well as observations on market events at the time they occurred. We have decided to publish these entries to give investors an open and honest insight into how we think about companies, about investing, and about our decision making process at the time of writing. The diary also allows us to look back and analyse our decisions without any hindsight bias, or view history through rose tinted glasses.

Important information

For Investment Professionals Only. These views represent the opinions of the named Fund Manager(s) as at the time of writing and do not constitute investment advice.

Where opinions are expressed they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is not intended as a recommendation to invest in any particular asset class, security or strategy. The information provided is for illustrative purposes only and should not be relied upon as a recommendation to buy or sell securities.

For full information on fund risks and costs and charges, please refer to the Key Investor Information Documents, Annual & Interim Reports and the Prospectus, which are available on the Evenlode Investment Management website (https://evenlodeinvestment.com). Recent performance information is also shown on factsheets, also available on the website.

Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Fund performance figures are shown inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors.

Current forecasts are provided for transparency purposes, are subject to change and are not guaranteed.

Source: Evenlode Investment Management Limited. Evenlode Investment Management Limited is authorised and regulated by the Financial Conduct Authority, No. 767844.